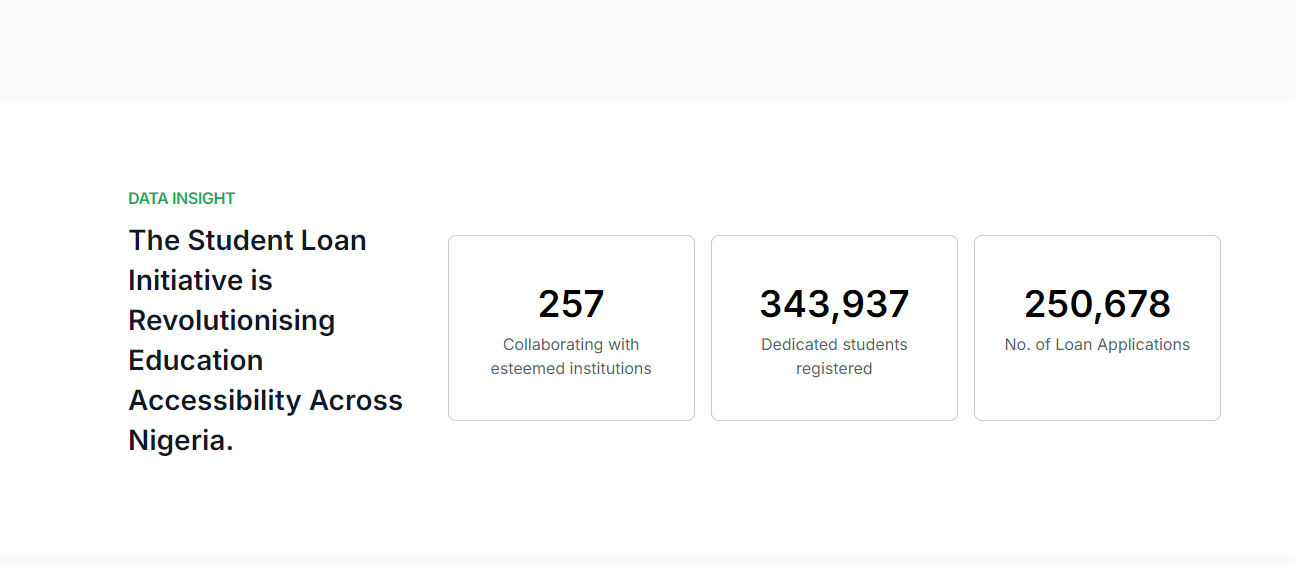

With 332,715 students registered and over 18,000 already receiving payments, the initiative is touted as a major step towards removing financial barriers to education in Nigeria.

The most significant change in the 2024 Education Loan Act is its new governance structure. The Act sets up the Nigeria Education Loan Fund (NELFUND) as a business-focused corporate body. While NELFUND will receive funding from 1% of government revenue collected by the Federal Inland Revenue Service (FIRS) and from legislative appropriations, it is also allowed to engage in business and trade with both movable and immovable assets. The appointment of renowned banker Jim Ovia as chairman on April 26 highlights NELFUND’s business-oriented approach.

Recently, the Director-General and Chief Executive Officer of the Nigeria Identity Management Commission (NIMC), Engineer Abisoye Coker-Odusote, announced significant progress in the federal government’s Student Loan initiative.

Speaking at the National Day of Identity 2024 event in Abuja, which was graced by top officials including the Secretary to the Government of the Federation (SGF), Senator George Akume, and the Permanent Secretary of the Ministry of Transportation, Dr. Magdalene Ajani, Coker-Odusote emphasized how Digital Public Infrastructure (DPI) is central to facilitating access to services such as education.

“The Student Loan Initiative showcases how DPI can eliminate financial barriers to education,” she said. The initiative allows the government to work in partnership with 257 institutions to provide financial support to students in need.

Unarguably, the student loan scheme is President Bola Tinubu’s key education policy in his first year. However, by concentrating solely on the loans without addressing the broader issue of higher education funding, the government is focusing on a branch rather than tackling the root problem. Poor funding is another significant challenge facing education in Nigeria. The country’s education budget is consistently below the recommended 26% of the total budget by the United Nations Educational, Scientific and Cultural Organization (UNESCO). In 2020, the education budget was only 12.5% of the total budget (National Assembly, 2020).

Similar Programmes Across the World

Nigeria’s student loan initiative follows the model of other countries that use similar schemes to support higher education. The Students Loan (Access to Higher Education Repeal and Re-enactment) Act 2024 represents a significant improvement over the previous law, which was seen as rushed to gain political favor with the youth. The new law allows all students in public higher institutions and government-approved vocational centers to access loans, regardless of their parents’ financial status. The loan can now cover more than just tuition, and students are solely responsible for repayment, starting two years after national service, at 10% of their income if employed. While the previous law declared the loan interest-free, the new Act suggests interest will be charged, though it does not specify the rate.

In the United States, the Federal Student Loan Programme helps millions of students, but it has faced growing concerns over the burden of student debt, with many graduates struggling to repay their loans for decades.

In Ghana, the student loan scheme was a financial arrangement under which all Ghanaian students who are enrolled and pursuing approved courses in an approved public tertiary institution were eligible to receive a loan regardless of their real financial needs.

In Australia, the Higher Education Loan Programme (HELP) also defers costs until a student’s income surpasses a certain threshold, but critics have argued that the repayment terms can be long, with some people paying off loans well into middle age.

South Africa faces similar issues with its National Student Financial Aid Scheme (NSFAS), where delays in disbursement and repayment enforcement have caused financial difficulties for students and the government alike.

“Pitfalls and Challenges in Nigeria”

Despite the optimism surrounding Nigeria’s student loan programme, several challenges remain. Critics have pointed out the potential pitfalls, many of which mirror the issues faced by other countries with similar schemes.

1. Repayment Concerns: One of the biggest challenges globally is ensuring that students can repay loans without becoming financially overburdened. Nigeria’s economy is currently grappling with high unemployment rates, and many graduates may find it difficult to secure well-paying jobs immediately after finishing school. Critics argue that without strong employment opportunities, the loan initiative could trap students in long-term debt.

2. Administrative Hurdles: Critics have raised concerns about the transparency and efficiency of the loan disbursement process. Instances of delayed payments or technical glitches with DPI could hinder students’ ability to pay for tuition and other expenses in a timely manner, similar to the administrative challenges seen in South Africa’s NSFAS.

3. Social Inequality: While the loan programme aims to make education more accessible, critics fear that it may disproportionately benefit students from urban areas with better access to educational institutions and digital infrastructure, leaving behind students in rural communities where digital and financial literacy may be lower.

4. Sustainability of the Programme: With the growing number of students registered for loans, there is also concern about the long-term sustainability of the initiative. Will the government have the resources to continue funding these loans, and how will defaults on repayments be managed? Some critics argue that the programme might place a strain on Nigeria’s finances in the future.

The Critics’ Perspective

Critics argue that while the Student Loan Initiative is a positive step, it may not fully address the deeper structural issues in Nigeria’s education system. Many education advocates believe the government should focus more on reducing the cost of higher education, improving job opportunities for graduates, and investing in quality infrastructure for schools. ONE OF PUNCH EDITORIALS: The student loan is a good idea, but not as a standalone panacea. Its implementation should be preceded by thorough planning, with realistic conditions, targets, and reliable funding sources.

“There’s a need for the government to not only provide loans but also ensure that students have the right environment to succeed,” said an educational consultant. “Without job creation and a supportive ecosystem, the repayment aspect could become a serious issue for many graduates.”

While Nigeria’s student loan programme has made impressive strides in providing financial support to students, challenges such as repayment, administration, and inclusivity remain. The government’s ongoing commitment to strengthening digital public infrastructure and ensuring broader access to education will determine the long-term success of the initiative. However, as seen in other countries, the road ahead may be fraught with both opportunities and obstacles.