About eight decades ago, the United Nations General Assembly declared access and participation in education as fundamental human rights for all citizens of the world. But today, funding amongst other factors has made education less of a right and more of a privilege.

Developing economies such as Nigeria, despite resounding declarations and commitments to the Sustainable Development Goals (SDG), lack the financial vigor to meet the educational needs of their teeming population, leaving millions without access to quality education.

Over 10 million Nigerian children do not have the opportunity to attend school. Many of the children who are lucky to be in the classrooms come with thread-bare uniforms or torn polythene school bags.

With the single-digit budgetary allocation to education as seen in the last ten years, Nigeria may never attain a breakthrough in the sector if education investments are left solely in the hands of the government. Hence the need for non-state actors on stage of education financing.

EDFIN: A non-state actor transforming education financing in Nigeria

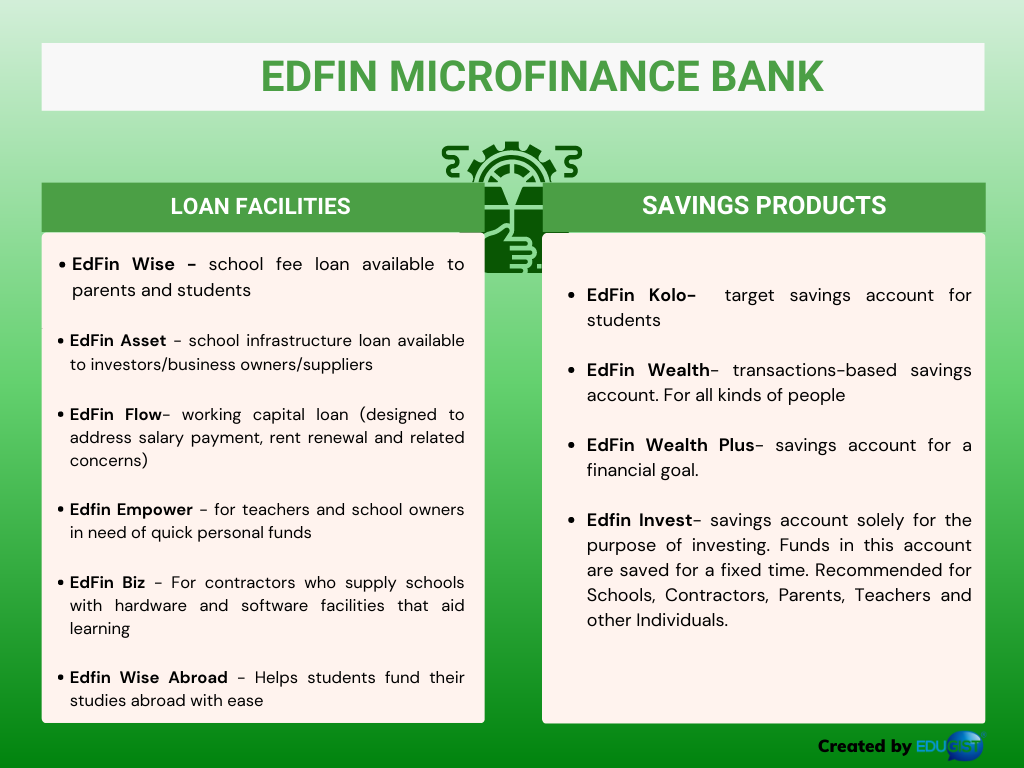

EdFin Microfinance Bank was birthed out of the need for quality education in Nigeria. The bank which is dedicated solely to funding the education eco-space in Nigeria aims to positively disrupt the standard and quality of education in Nigeria, by providing much-needed financial resources and services to the education sector.

Founded in collaboration with Atlanta-headquartered Gray Matters Capital (GMC) an impact investment venture capital firm based in the United States of America, EdFin is focused on facilitating a more enabling environment for learning to thrive in Nigeria.

In this interview with Edugist’s Grace Aderemi-John, Edfin CEO, Bunmi Lawson speaks on how Edfin addresses the funding challenge for the key players in the education sector –parents, students, teachers, investors and governments.

EDFIN commenced operations in 2019, just a year before the COVID pandemic. In over three years of your existence, how would you describe people’s perception of securing loans for education?

In Nigeria, especially in low-income households, traditionally, people hold education very high. However, I know that the economic hardship has reduced some of that, the result of which has been an increase in the number of out-of-school children. This is because parents affected by the economic hardship may be weighing the cost of sending their children to school and enlisting them to help with their business. However, I believe most parents do recognise that having access to education, helps their children come out of poverty, because through education they can get a better job. Where the children decide not to work for anybody, they can better assist their parents in their business and even take it to the next level.

So, we have seen for instance, where a woman who is selling fish sends her child to school. After school, the child takes over the business and revamps it, and before you know it, starts repackaging and selling the fish to other states in Nigeria.

Through these examples, we try to enlighten parents on the importance of education. I can affirm that there are Nigerians who are very passionate about education who actually help to spread the word. It is our hope that once we start to see economic growth, more parents will actually send their children back to school. And then the loan we have provided will make it easier for them.

For instance, when you want to pay school fees, you are paying for a whole term but if you take a loan, you can repay the loan monthly, maybe that’s how you end your money. So, you don’t have to start looking at how to pay the money because you can split it monthly. We even have plans where you can repay your loan on a daily basis, pending on the capacity of the borrower. This is done to ensure the burden is not hard on them.

Asides parents, how does EDFIN provide funding support to students?

Now, for those who, for instance, want to further their education, such as going for a Master’s degree in a Nigerian university or an institution abroad but do not have the funding, we provide loans to students.

For international students, we have partnered with organisations to provide loans to students. Students need not repay that loan until they graduate, they only pay the interest. As a matter of fact, we did a calculation that shows that if the student works on Saturdays, earning a minimum wage, they will be able to pay the interest on the loan while in school, then after graduation when they get a job, they can repay the loan. These are the kinds of offerings that we provide to help remove the burden in terms of the cost of education for both parents, students and schools.

Education is a good business, and like parents, educators and students, investors also need financial support. How does EDFIN provide financial services to potential investors?

For investors, if you have a school, and require funding, you can either go to our website and apply for a loan. You should have been running the school for at least two years, that enables us to have a tracker. After applying online, our relationship officers will come to your school to do an evaluation (check how many students you have in school, your school fees). All of that is done to determine the capacity of the investor to repay the loan.

This also helps us structure the repayment plan. We also have the list of documents they’re supposed to provide, that enables us to determine their capacity to pay the loan as well as their willingness. Since the inception of EDFIN, we have served more than 500 schools and we hope to do more.

What solutions does EDFIN provide besides loan?

We have savings products. You can open a savings account with us. We also add on insurance, we provide life insurance, HMO for schools and of course payments, you can open an account and make payments transfers to third party accounts. We do everything a bank does apart from providing foreign currency.

Our products and solutions are more in the areas of providing access to finance. For example, if you are seeking admission abroad and you need proof of funds, EDFIN provides this service. Also, you own a school, you are a vendor that supplies school equipment, or you work in the education sector ( a teacher, lecturer, etc) and need a loan, we provide loans to you.

Now, we included a new product, EDFIN Biz, which is targeted towards small and medium enterprises (SMEs). The goal is to provide loans to parents who own businesses so that they are better empowered to fund their children’s schooling. Our core focus, I would say is more of loans then we provide saving products and payment channels.

grace.aderemi@edugist.org

grace.aderemi@edugist.org